What is a NAICS code?

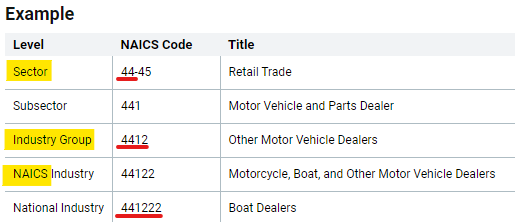

A North American Industry Classification System (NAICS) code is a six-digit numerical code used to categorize industries and track historical business data. The NAICS system was developed by the Office of Management and Budget (OMB) in 1997, to replace the Standard Industrial Classification (SIC) system, which was developed in the 1930s. NAICS has been adopted by Canada and Mexico to allow a high level of comparability in business statistics.

NAICS is used by many agencies. The U.S Census Bureau (Census), Internal Revenue Services (IRS), and Department of Labor’s (DOL) Bureau of Labor Statistics (BLS), among others, have been using it since 1997. The NAICS system is evaluated and updated every five (5) years beginning in 2002 and the changes in 2022 are been updated as some codes have disappears and been re-mapped, like under NAICS 511 (Publishers).

Do you know the value of your NAICS code?

NAICS is used by the Small Business Administration (SBA) and companies doing business with the government to classify transaction as small or large. All federal government agencies use a NAICS code for every opportunity listed in the System for Award Management (SAM) as well as every award that it makes. A company can choose multiple NAICS codes and may be both a small and large within different NAICS classifications.

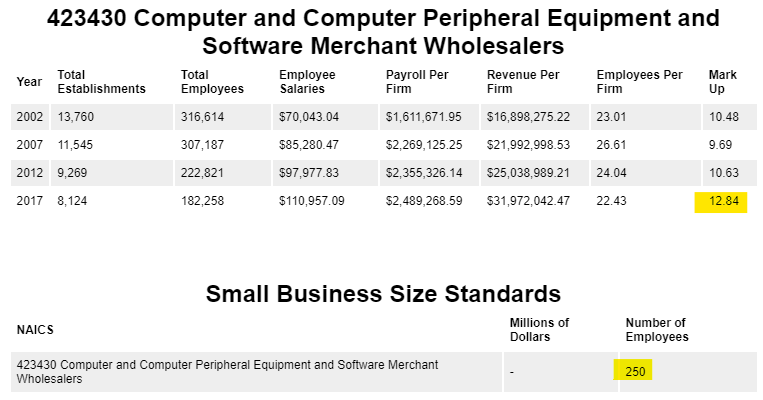

For example, a software company may represent under 423430 (Computer and Computer Peripheral Equipment and Software Merchant Wholesalers), which has a size standard of 250 employees. The same company may also represent under 511210 (Software Publishers in 2017; now 513210 as of 2022) which has a $41.5M dollar threshold, under a different opportunity.

What this means is a BILLION-dollar software company with 245 employees is considered a small business under NAICS code 423430, but not under 513210.

That BILLION-dollar company would be highly motivated to keep its work under 423430 so it can compete as a small business under certain opportunities. The same company would need to certify as large business under 513210 as it could not classify as a small business under the 513210 designated NAICS code with a revenue threshold of $41.5M annually.

Get NAICS insights!

Understanding your NAICS code and selecting the right ones for your business is critical for your long terms success in federal government contracting! #govcon

PTW Solutions, Inc. #PTW has created a (beta) tool to provide a user with a high-level analysis of each NAICS code.

You can get insights from almost 20 years of data that calculated average markups, i.e. wrap rate. The markups include fringe, overhead, G&A, and profit from each industry. The markups represents the spread between total revenues and total payroll costs.

We appreciate and are grateful for your feedback as you use the NAICS analysis tool so we can make improvements based on usage from our community!

Thank you and have a great week!

Great mix of humor and insight! For more, click here: READ MORE. Let’s discuss!